Can I Trade on an Online Platform?

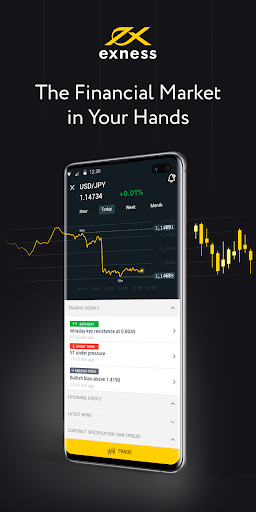

If you’re wondering “can I trade on an online platform?” you are not alone. Many individuals today are considering the potential of trading in various financial markets from the comfort of their homes. The advent of technology and the internet has made it easier than ever to engage in trading activities, whether it’s forex, stocks, or cryptocurrencies. Before diving into trading, it’s essential to understand the basics, the platforms available, and the strategies that can help you navigate this complex landscape. One popular choice for traders is the can i trade on an unverified account exness aplikasi Exness, which offers a user-friendly interface and various trading options.

Understanding Trading Basics

To determine if you can trade on an online platform, it is crucial to grasp the fundamentals of trading. At its core, trading involves buying and selling financial assets with the aim of making a profit. These assets can include stocks, bonds, commodities, and currencies. The primary goal of trading is to take advantage of market movements to achieve profit.

Choosing the Right Trading Platform

One of the first steps in trading is selecting the right platform. Various online trading platforms cater to different types of traders, from beginners to experienced ones. Factors to consider when choosing a platform include:

- User Interface: The platform should be easy to navigate.

- Fees and Commissions: Look for platforms with competitive fees.

- Asset Variety: Ensure the platform offers the types of assets you wish to trade.

- Educational Resources: A platform with tutorials and market analysis can be beneficial.

- Customer Support: Reliable customer support can assist you when issues arise.

Is Trading on an Online Platform Right for You?

Determining whether you can trade successfully online depends on various factors, including your risk tolerance, financial goals, and market knowledge. Here are some questions to ask yourself:

- What is my risk tolerance? Can I handle potential losses?

- What are my financial goals? Am I looking for short-term gains or long-term investments?

- How much time can I dedicate to learning and trading?

Trading Strategies to Consider

Successful trading often requires a solid strategy. Here are a few strategies to consider:

- Day Trading: This involves buying and selling assets within a single trading day.

- Swing Trading: Traders hold positions for several days or weeks to capitalize on expected market moves.

- Scalping: This strategy focuses on making small profits from minor price changes, often executed multiple times a day.

- Position Trading: A long-term strategy where traders hold assets for an extended period, ignoring short-term fluctuations.

Risk Management in Trading

Risk management is a critical aspect of trading. Without a solid risk management strategy, traders can quickly face substantial losses. Here are some essential risk management tips:

- Use Stop-Loss Orders: This helps to automatically sell an asset when it reaches a certain price, limiting potential losses.

- Diversify Your Portfolio: Avoid putting all your funds into one asset. Spread your investments to reduce risk.

- Only Trade with Money You Can Afford to Lose: This principle is fundamental in ensuring you do not face financial hardship due to trading losses.

- Set Realistic Goals: These should be achievable based on your current knowledge and market conditions.

Staying Informed About the Markets

To enhance your chances of success in trading, staying informed about market trends and global events is crucial. Follow financial news, read trading blogs, and consider joining trading forums. Understanding how economic indicators, geopolitical events, and financial reports affect the markets will enable you to make informed trading decisions.

Emotional Discipline in Trading

Trading can be an emotional rollercoaster. It’s vital to develop emotional discipline to avoid making impulsive decisions based on fear or greed. Here are some tips:

- Stick to Your Trading Plan: Have a clear plan and adhere to it, regardless of emotional reactions during trading.

- Take Breaks: If you feel overwhelmed, step away from your trades and regain composure.

- Keep a Trading Journal: Document your trades, thoughts, and emotions to recognize patterns in your behavior.

Final Thoughts

So, can you trade on an online platform? The answer largely depends on your preparedness, knowledge, and commitment to learning. The accessibility of trading today offers exciting opportunities, but success requires diligence, research, and effective strategies. By choosing the right platform, managing your risks, keeping informed, and maintaining emotional discipline, you can navigate the trading landscape with confidence. Remember, the journey of trading is not just about making profits; it’s about continuous learning and growth.