Exness Account Comparison: Which Account is Right for You?

Choosing the right trading account is a crucial step for any trader, whether you’re a beginner or an experienced professional. In this Exness account comparison, we will explore the different account types offered by Exness to help you make an informed decision that aligns with your trading goals. Additionally, we will look at the advantages and disadvantages of each account type, trading conditions, spreads, leverage, and much more. You can also check out exness account comparison Exness Zambia for further information specific to your region.

Overview of Exness

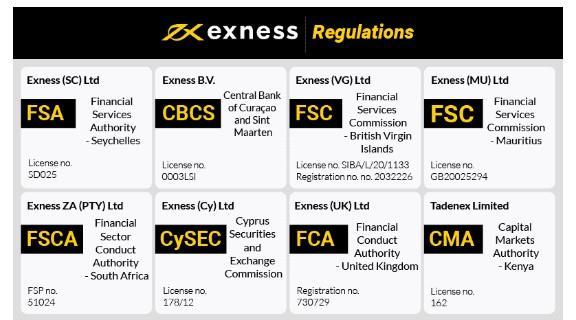

Exness is a well-established online trading platform that offers a variety of financial instruments, including forex, cryptocurrencies, commodities, and stocks. Founded in 2008, Exness has garnered a reputation for its transparent trading environment and a range of account types designed to meet the diverse needs of its global customers. Whether you are a scalper, day trader, or swing trader, Exness has something to suit your trading style.

Account Types Available at Exness

Exness provides its customers with several account options, each tailored to different trading preferences and experience levels. The main account types available are Standard, Pro, Zero and ECN accounts. Let’s take a closer look at each of these options.

1. Standard Account

The Standard account is an excellent choice for beginners who are just starting their trading journey. It offers:

- Minimum deposit: $1

- Leverage: Up to 1:2000

- Spread: From 0.3 pips

- Commission: None

- Ideal for: New traders looking for a simple trading experience

The simplicity of the Standard account, coupled with a relatively low cost of entry, makes it appealing to those who are testing the waters before committing larger sums of capital.

2. Pro Account

The Pro account is designed for more experienced traders who require tighter spreads and enhanced trading conditions. Features of the Pro account include:

- Minimum deposit: $200

- Leverage: Up to 1:2000

- Spread: From 0.1 pips

- Commission: None

- Ideal for: Traders looking for better trading conditions without high costs

This account type is particularly suitable for those looking to implement different trading strategies that require lower transaction costs.

3. Zero Account

The Zero account aims to eliminate spreads, offering more flexibility for traders who rely on high-frequency trading strategies. Key features include:

- Minimum deposit: $500

- Leverage: Up to 1:2000

- Spread: From 0.0 pips

- Commission: $3.5 per lot per side

- Ideal for: Scalpers and professionals seeking the best execution

This account type is perfect for traders who prioritize execution speed and precision over low transaction costs.

4. ECN Account

The ECN account is tailored for professional traders and institutions looking for high-level features. Its characteristics include:

- Minimum deposit: $300

- Leverage: Up to 1:200

- Spread: Variable, depending on the market

- Commission: $3.5 per lot per side

- Ideal for: Experienced traders requiring direct market access

The ECN account offers superior trading capabilities, including access to the interbank market, making it a great choice for advanced trading strategies.

Comparing Trading Conditions

When evaluating Exness accounts, it is essential to consider various trading conditions that can impact your trading experience. Here’s a direct comparison of key factors affecting each account type:

| Feature | Standard | Pro | Zero | ECN |

|---|---|---|---|---|

| Minimum Deposit | $1 | $200 | $500 | $300 |

| Leverage | 1:2000 | 1:2000 | 1:2000 | 1:200 |

| Spread | From 0.3 pips | From 0.1 pips | From 0.0 pips | Variable |

| Commission | None | None | $3.5 per lot | $3.5 per lot |

Evaluating Your Trading Needs

The choice of account type should align with your trading objectives and experience. It is crucial to evaluate the following considerations:

- Trading Style: Are you a long-term investor, a swing trader, or a scalper? This will determine the type of spreads and commissions you can handle.

- Capital Availability: How much capital can you commit? Your initial deposit can significantly influence your choice of account.

- Risk Tolerance: High leverage can amplify gains but also increase risks. Ensure you are comfortable with the level of risk associated with your chosen account.

- Withdrawal and Deposit Methods: Consider the various methods available for deposits and withdrawals, as this may impact your trading strategy.

Conclusion

In summary, the Exness account comparison reveals that each trading account serves different purposes and meets varying trader requirements. Whether you are a budding trader opting for a Standard account or an expert professional choosing the ECN account, understanding the differences can significantly enhance your trading experience. Always ensure that your chosen account aligns with your trading goals, risk tolerance, and strategies to achieve the best outcomes in your trading endeavors.